Compiled by Satyaki Dutta

Aviation industry plays a major role in overall travel and tourism sector with more than 57 per cent of global economic contribution to tourism (direct, indirect and induced) which was over 7.6 trillion U.S. dollars in 2016. In developing countries, tourism plays a pivotal role in the economic development strategies, depending on the steady influx of overseas visitors. More than 83 per cent of tourists arrive by air, and contributed over US$49 billion in GDP in the economy of the mid-African countries.

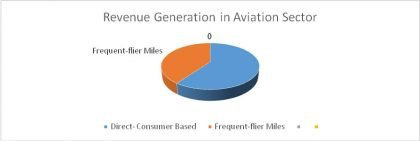

Revenue generation sources in Aviation sector: Revenue generation in Aviation sector is dependent on two fronts – 60 per cent of the revenue comes directly from consumers and the remaining from selling frequent-flier miles to credit card companies. In consumer revenue, business travellers consist of 12 per cent of passengers but often more than twice as profitable for airlines.

On some flights, business passengers represent 75 per cent of an airline’s profits. Business travellers contribute more than leisure travellers in consumer revenue, because first-class and business tickets may cost 10 times the price of coach tickets. Compared to economy price, premium pricing typically brings passengers better service and higher quality facilities. With the goal to attract new customers, many airlines introduce innovative services or refit aircraft for more first-class legroom.

Full-fledged travellers and business travellers bring substantial revenue to airlines by opting for additional services and using frequent-flier programs along with other incentive programs.

Job generation through aviation sector:

Direct: Globally, 15.6 million jobs in tourism globally are directly estimated to be supported aviation sector, especially with foreign revenue. The industries such as hotels, restaurants, tourist attractions, local transport and car rental etc. are included in it.

Indirect: 14.1 million indirect jobs in industries are supported indirectly in the tourism industry by visitors arriving by air.

Induced: These direct and indirect tourism jobs supported by air transport generate a further 7 million jobs in other parts of the economy, where the profit generated are spent in general sectors.

Thus, this sector accounts for the contribution to around US$947 billion a year to world GDP.

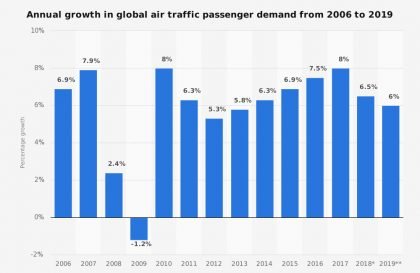

Global air traffic passenger growth rate in recent times: This bar chart represents the annual growth in global air traffic passenger demand between 2006 and 2019. Global air traffic passenger demand is estimated to increase by eight per cent in 2018 over 2017. By 2019, traffic is projected to grow six per cent.

The Direct impact of aviation over tourism:

According to tourism industry analysts STR, there was a healthy rise in room occupancy rates in 2019, beginning in January with 58.1 per cent of hotel rooms filled compared to 47.1 percent in January 2017 — an increase of 23.3 percent, the highest for the year. Occupancy has gradually grown through 2018. In the Red Sea resorts, occupancy in 2017 was languishing at between 30.8 percent in January to 44.2 percent in August. This year there was 45.5 percent occupancy in January, rising steadily to 56.2 percent in August.

Changing of the profit margin trend in full-fledged vs budget travel options:

Compared to the full-fledged travel class, the budget air travel is skyrocketing at present. The rising middle classes in emerging economies are expected to help global air traffic grow at an average annual growth rate of four percent till 2034. Regions like Latin America and China are on the verge of becoming key markets for the aviation industry. Chinese tourists spent around 300 billion US dollars during their holidays outside their home country.

In 2017 for the USA, the rate of mishandled bags per 1,000 passengers dropped to 2.5 compared with 5.26 in 2008. Along with this, the percentage of passengers who are not allowed to board the oversold flights is on the decline.

With the goal of capturing the economic/budget travellers, Low-cost carriers (LCC) have become a popular alternative to traditional scheduled airlines over the last two decades. The low-cost model emphasises on business and operational models that effectively reduce airline costs. These models include opting for secondary airports further from the major cities, offering no frills on the flight, charging for services like seat reservation and checked-in baggage, legroom etc.

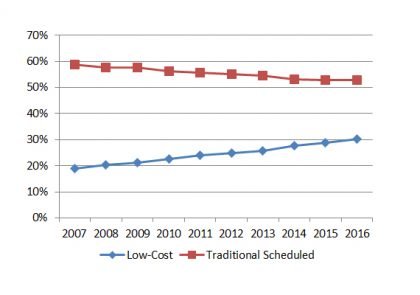

According to the STATFOR figure, the Low-cost segment consists of 19 percent in 2007 and raised to 30 percent in 2016, almost a third of total air-traffic. On the other hand, the traditional scheduled segment’s share of all flights faced a rapid fall, from 59 percent in 2007 to 53 percent in 2016.

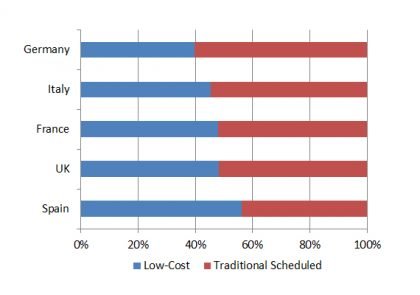

The European countries with most cost-effective traffic are Germany, Spain, Italy, France and the United Kingdom. In Spain, LCCs are more popular than traditional scheduled; but in other countries, the traditionally scheduled segment is still in the majority.

According to the World Tourism Organisation (UNWTO), international tourist arrivals grew for the seventh consecutive year, reaching 1.2 billion in 2016. Asia and the Pacific regions have shown the strongest growth, with the new rising trend of budget travel.